In today’s competitive financial landscape, loan portfolio optimization is essential for financial institutions aiming to maximize returns, manage risks, and ensure long-term growth. Effective portfolio optimization not only strengthens the balance sheet but also builds customer trust and market reputation. This guide explores the key strategies and tools that can help institutions optimize their loan portfolios and drive sustainable growth.

What Is Loan Portfolio Optimization?

Loan portfolio optimization involves managing and adjusting a portfolio of loans to balance risk and return. It is a strategic approach that ensures a financial institution achieves its growth objectives while adhering to regulatory requirements and maintaining a healthy risk profile.

Why Is Portfolio Optimization Important?

- Risk Management: Minimize defaults and credit risk through diversification and robust credit evaluation.

- Maximized Returns: Identify high-yield opportunities without compromising stability.

- Regulatory Compliance: Maintain adherence to capital adequacy and liquidity requirements.

- Customer Retention: Align lending practices with customer needs to foster loyalty.

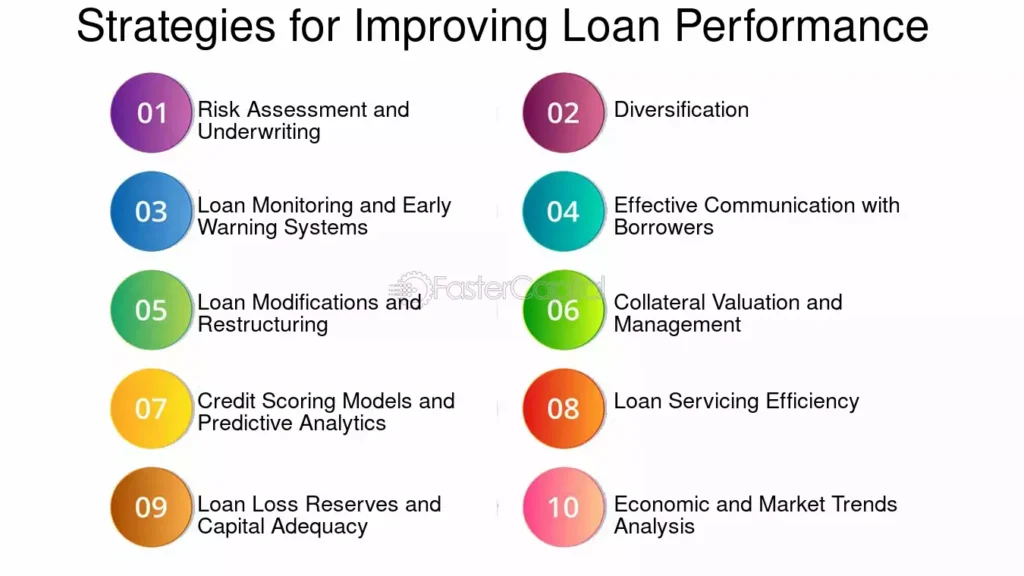

Key Strategies for Portfolio Optimization

1. Diversification

Diversification is one of the most effective ways to mitigate risk in a loan portfolio. By spreading investments across different sectors, geographies, and borrower profiles, institutions can minimize the impact of localized downturns or sector-specific challenges.

- Sectoral Diversification: Avoid over-concentration in a single industry. For example, balance loans across manufacturing, technology, and retail sectors.

- Geographic Diversification: Expand lending across different regions to reduce exposure to regional economic fluctuations.

- Borrower Segmentation: Include a mix of small businesses, corporates, and individuals in the portfolio.

2. Advanced Risk Assessment

Effective risk assessment involves evaluating the creditworthiness of borrowers and the potential risks associated with loans.

- Credit Scoring Models: Use predictive analytics to assess borrower risk accurately.

- Stress Testing: Simulate adverse scenarios, such as economic downturns or interest rate hikes, to assess portfolio resilience.

- Risk-Based Pricing: Set interest rates based on the borrower’s risk profile, ensuring adequate compensation for higher-risk loans.

3. Data-Driven Decision Making

Leverage data analytics and technology to gain insights into portfolio performance and market trends.

- Loan Performance Metrics: Monitor key indicators such as delinquency rates, charge-offs, and prepayments.

- Predictive Analytics: Use machine learning models to forecast borrower behavior and potential risks.

- Market Insights: Stay informed about economic trends and adjust lending strategies accordingly.

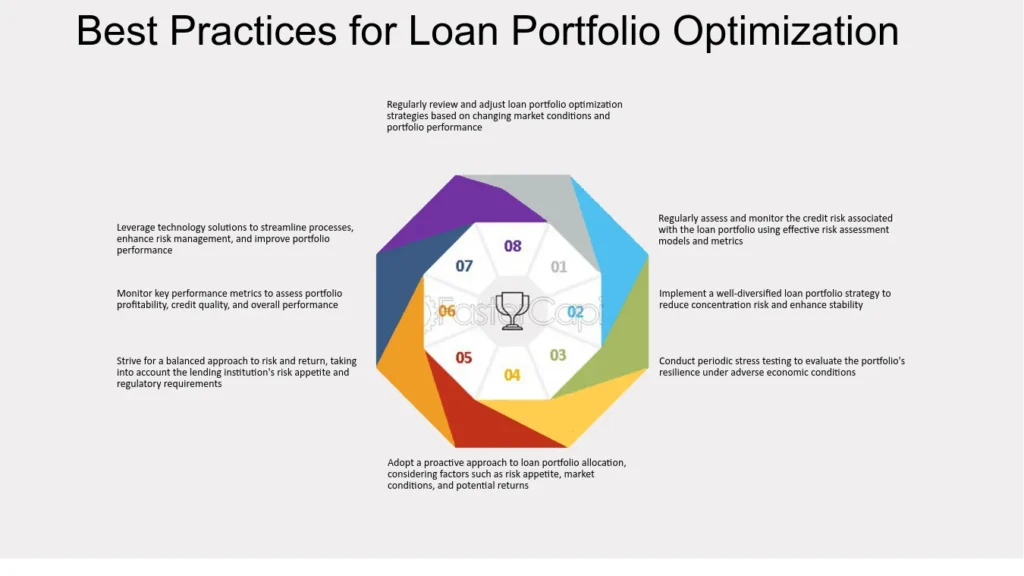

4. Dynamic Portfolio Rebalancing

Regularly review and adjust the composition of the loan portfolio to adapt to changing market conditions.

- Reallocate Resources: Shift focus to high-growth sectors or regions showing strong economic performance.

- Manage Maturity Profiles: Balance short-term and long-term loans to ensure liquidity and steady cash flows.

- Exit Non-Performing Loans (NPLs): Proactively identify and address problematic loans to minimize losses.

5. Customer-Centric Lending

Align lending practices with the needs and preferences of your customer base to enhance satisfaction and retention.

- Tailored Loan Products: Offer customized loan solutions based on customer profiles.

- Digital Platforms: Simplify the application and disbursement process through online channels.

- Transparent Communication: Build trust by providing clear terms and regular updates.

6. Integration of Technology

Technology plays a vital role in optimizing loan portfolios by automating processes, improving accuracy, and enhancing decision-making.

- AI and Machine Learning: Automate credit assessments and identify patterns in borrower behavior.

- Blockchain Technology: Enhance transparency and security in loan transactions.

- Loan Management Systems: Streamline operations with integrated software solutions.

7. Compliance and Regulatory Alignment

Adherence to regulations is critical for maintaining a healthy loan portfolio and avoiding penalties.

- Capital Adequacy Ratios: Maintain sufficient reserves to cover potential losses.

- Know Your Customer (KYC): Implement robust due diligence processes to prevent fraud and money laundering.

- Reporting Standards: Ensure timely and accurate reporting to regulators.

Benefits of Loan Portfolio Optimization

- Improved Profitability: Enhanced risk-adjusted returns contribute to higher profits.

- Reduced Default Rates: Effective risk management lowers the likelihood of loan defaults.

- Stronger Market Position: A well-managed portfolio attracts investors and builds credibility.

- Customer Satisfaction: Tailored solutions and efficient processes improve the borrower experience.

SEE MORE: The-ultimate-guide-to-elderly-living-options-for-your-old-grandma-2025

Challenges in Loan Portfolio Optimization

- Data Limitations: Incomplete or inaccurate data can hinder effective decision-making.

- Market Volatility: Rapid changes in economic conditions require agility and proactive management.

- Technological Integration: Adopting new technologies involves significant investment and learning curves.

- Regulatory Changes: Frequent updates to laws and guidelines can complicate compliance efforts.

Case Study: Successful Portfolio Optimization

A mid-sized bank identified a high concentration of loans in the real estate sector, increasing its exposure to market downturns. By diversifying into technology and renewable energy, the bank reduced its risk profile and achieved a 15% increase in overall returns within two years. Additionally, the adoption of AI-driven analytics improved loan approval times and customer satisfaction rates.

The Future of Portfolio Optimization in Loans

As the financial industry evolves, portfolio optimization strategies must adapt to emerging trends:

- Sustainability: Prioritize green financing and environmentally friendly projects.

- Real-Time Analytics: Use live data to make instant adjustments to portfolios.

- Personalization: Develop hyper-personalized loan products to cater to diverse customer needs.

Conclusion

Loan portfolio optimization is a vital process for financial institutions seeking growth, stability, and competitive advantage. By leveraging strategies like diversification, data-driven decision-making, and advanced technology, organizations can enhance profitability while minimizing risks. In a dynamic financial environment, staying proactive and adaptable ensures sustained success in portfolio management.

FAQs

- What is the primary goal of loan portfolio optimization?

To balance risk and return while ensuring long-term growth and compliance. - How can technology improve loan portfolio management?

Technology enables accurate risk assessment, real-time analytics, and streamlined processes, enhancing decision-making and efficiency. - Why is diversification important in a loan portfolio?

Diversification minimizes exposure to sector-specific or regional risks, ensuring portfolio stability. - What role does customer-centric lending play in optimization?

It improves customer satisfaction and retention by offering tailored loan solutions and seamless experiences. - How can financial institutions manage non-performing loans effectively?

By proactively identifying issues, restructuring terms, or offloading bad loans to minimize losses.